Vehicle Control Temperature Control Engineered Solutions

May 05, 2021 / Financial

Standard Motor Products, Inc. Announces First Quarter 2021 Results and a Quarterly Dividend

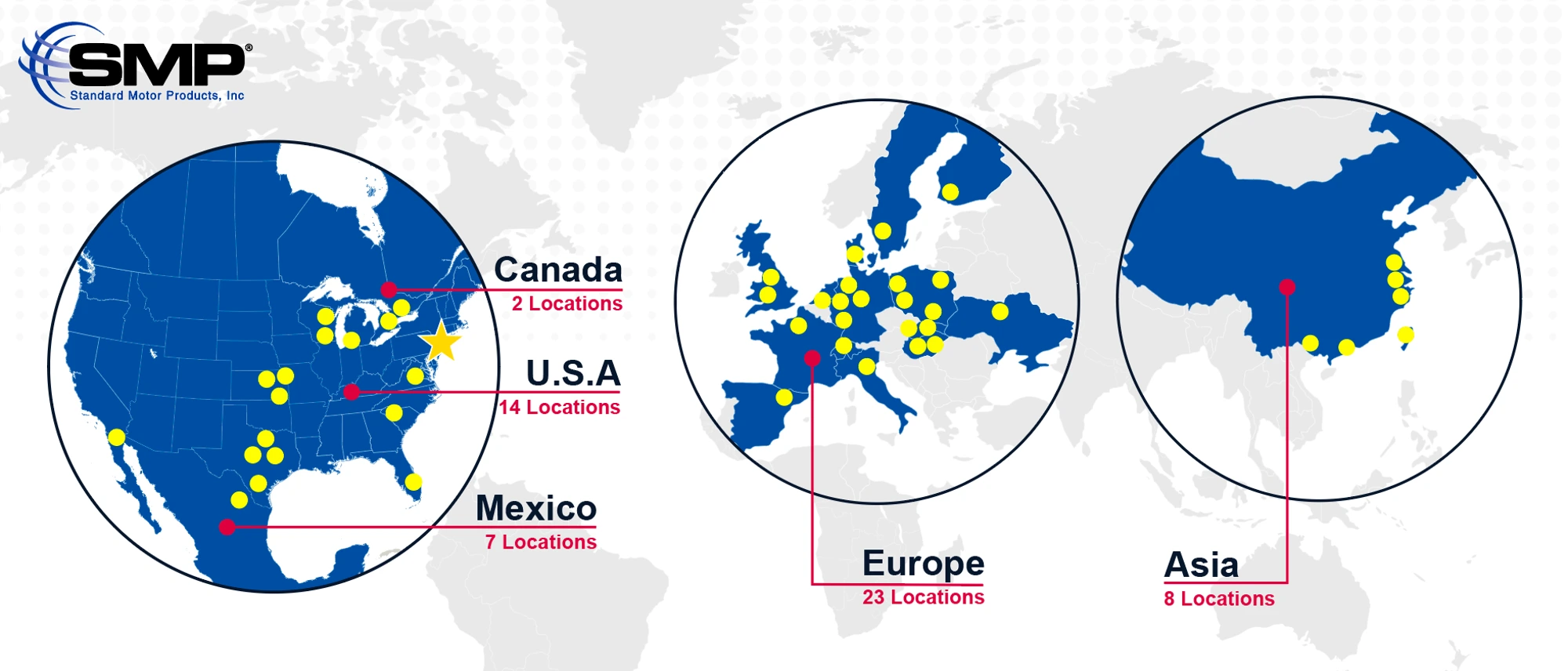

SMP, a leading automotive parts manufacturer and distributor, reported today its consolidated financial results for the three months ended March 31, 2021.

Consolidated net sales for the first quarter of 2021 were $276.6 million, compared to consolidated net sales of $254.3 million during the comparable quarter in 2020. Earnings from continuing operations for the first quarter of 2021 were $22.2 million or 97 cents per diluted share, compared to $9.6 million or 42 cents per diluted share in the first quarter of 2020. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the first quarter of 2021 were $22.2 million or 97 cents per diluted share, compared to $9.8 million or 43 cents per diluted share in the first quarter of 2020.

Mr. Eric Sills, Standard Motor Products’ Chief Executive Officer and President stated, “We are very pleased with our first quarter results, as the momentum from the second half of 2020 carried over into 2021. Net sales were 8.7% above the first quarter of 2020, with both divisions showing gains. It is important to note that comparisons to last year will become less relevant due to COVID-19 impacts last year, though the first quarter of 2020 was only modestly affected.

“Engine Management net sales were up 5.4% as compared to 2020. Although we had a substantial reduction in sales in the quarter from the loss of a major account (previously announced), we were very pleased to see strong demand from our other customers offsetting the loss. Looking at our customer POS, their sell-through was even more encouraging, where many accounts enjoyed gains well into the double digit range. We believe that the actions we have taken to support our customers in the field are having success. Furthermore, we have secured new business wins, which will phase in over the course of the next several months.

“Temperature Control sales were ahead 21.4%. However, the first quarter essentially reflects pre-season orders, which, as previously discussed, were very light last year. Our pre-season orders continue to be strong in the second quarter as our customers replenish their shelves from a hot 2020 summer, though the full year results will be heavily dependent on how hot this summer will be.

“Gross margin was substantially above the first quarter of 2020, as factory production has remained at high levels throughout the company in our effort to rebuild our inventory. While we expect the ongoing benefit of robust production levels, we do see some offsetting headwinds as we face various inflationary costs in labor, certain raw materials, and transportation.

“Operating expenses were reduced slightly in the quarter. We continue to benefit from discretionary cost reductions instituted during the pandemic, though these were partially offset by increased distribution expense due to higher sales and elevated freight costs.

“The result was an all-time record in first quarter earnings, with non-GAAP diluted EPS from continuing operations more than doubling, from 43 cents in 2020 to 97 cents in 2021.

“We are also very pleased with our progress towards expanding our business in OE commercial vehicle / off-road markets. We have been developing this business for several years, and have recently fortified it with two excellent acquisitions, both from Stoneridge, Inc. In 2019 we acquired their Pollak business, and in March of this year we acquired their particulate matter sensor business (more commonly known as soot sensors). We believe that this OE commercial vehicle focus will provide an excellent growth path for us, and the products we are developing for this segment will strengthen our offering in our core aftermarket business.

“Overall, we are pleased with our momentum as we exit the first quarter. We continue to see strong incoming orders from our customers, which reflect the healthy POS increases they are experiencing. The economy continues to improve, and more people are returning to work. This leads to more cars on the road and increased miles driven, one of the key determinants for our industry. We look forward to the balance of the year.

“Lastly, the Board of Directors has approved payment of a quarterly dividend of 25 cents per share on the common stock outstanding. The dividend will be paid on June 1, 2021 to stockholders of record on May 17, 2021.”

View Consolidated Financial StatementsConference Call

Standard Motor Products, Inc. will hold a conference call at 11:00 AM, Eastern Time, on Wednesday, May 5, 2021. The dial-in number is 800-896-8445 (domestic) or 785-830-1916 (international). The playback number is 800-839-5630 (domestic) or 402-220-2557 (international). The participant passcode is 62175.

Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Standard Motor Products cautions investors that any forward-looking statements made by the company, including those that may be made in this press release, are based on management’s expectations at the time they are made, but they are subject to risks and uncertainties that may cause actual results, events or performance to differ materially from those contemplated by such forward-looking statements. Among the factors that could cause actual results, events or performance to differ materially from those risks and uncertainties discussed in this press release are those detailed from time-to-time in prior press releases and in the company’s filings with the Securities and Exchange Commission, including the company’s annual report on Form 10-K and quarterly reports on Form 10-Q. By making these forward-looking statements, Standard Motor Products undertakes no obligation or intention to update these statements after the date of this release.

For more information, contact:

Anthony (Tony) Cristello

(972) 316-8107

tony.cristello@smpcorp.com

Previous News

March 08, 2021 / Financial

Standard Motor Products, Inc. Announces Acquisition of Particulate Matter Sensor Business of Stoneridge, Inc.

Next News

June 01, 2021 / Financial

Standard Motor Products, Inc. Announces Acquisition of Trombetta

Related News

Vehicle Control Temperature Control Engineered Solutions

September 17, 2024 / Financial

SMP Announces New $750 Million Credit Facility

Vehicle Control Temperature Control Engineered Solutions

May 01, 2024 / Financial

SMP Announces First Quarter 2024 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

April 29, 2024 / Financial

SMP Announces First Quarter 2024 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

February 22, 2024 / Financial

SMP Releases Fourth Quarter and 2023 Year-End Results

Vehicle Control Temperature Control Engineered Solutions

February 20, 2024 / Financial

SMP Announces Fourth Quarter and Year End 2023 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

February 05, 2024 / Financial

Standard Motor Products, Inc. Announces Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

October 27, 2023 / Financial

SMP Announces Third Quarter 2023 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

October 25, 2023 / Financial

SMP Announces Third Quarter 2023 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

August 02, 2023 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2023 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

July 27, 2023 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2023 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

May 03, 2023 / Financial

Standard Motor Products, Inc. Announces First Quarter 2023 Results

Vehicle Control Temperature Control Engineered Solutions

April 28, 2023 / Financial

Standard Motor Products, Inc. Announces First Quarter 2023 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

February 18, 2022 / Financial

Standard Motor Products, Inc. Announces Fourth Quarter and Year End 2021 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

February 22, 2022 / Financial

Standard Motor Products, Inc. Announces Fourth Quarter and 2021 Year-End Results

Vehicle Control Temperature Control Engineered Solutions

April 29, 2022 / Financial

Standard Motor Products, Inc. Announces First Quarter 2022 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

May 03, 2022 / Financial

Standard Motor Products, Inc. Announces First Quarter 2022 Results and a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

June 02, 2022 / Financial

Standard Motor Products, Inc. Announces New $500 Million Credit Facility

Vehicle Control Temperature Control Engineered Solutions

August 01, 2022 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2022 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

August 03, 2022 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2022 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

October 28, 2022 / Financial

Standard Motor Products, Inc. Announces Third Quarter 2022 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 01, 2021 / Financial

Standard Motor Products, Inc. Announces a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 23, 2021 / Financial

Standard Motor Products, Inc. Announces Fourth Quarter and 2020 Year-End Results

Vehicle Control Temperature Control Engineered Solutions

August 04, 2021 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2021 Results and a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

October 28, 2021 / Financial

Standard Motor Products, Inc. Announces Third Quarter 2021 Results, New Stock Repurchase Program and a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

January 31, 2020 / Financial

Standard Motor Products, Inc. Announces Increase in Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 19, 2020 / Financial

Standard Motor Products, Inc. Announces Fourth Quarter and 2019 Year-End Results

Vehicle Control Temperature Control Engineered Solutions

March 06, 2020 / Financial

Standard Motor Products, Inc. Announces New Stock Repurchase Program

Vehicle Control Temperature Control Engineered Solutions

April 29, 2020 / Financial

Standard Motor Products, Inc. Discusses COVID-19 Business Impact and Announces First Quarter 2020 Results

Vehicle Control Temperature Control Engineered Solutions

July 29, 2020 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2020 Results

Vehicle Control Temperature Control Engineered Solutions

October 28, 2020 / Financial

Standard Motor Products, Inc. Announces Third Quarter 2020 Results and Reinstates Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 04, 2019 / Financial

Standard Motor Products, Inc. Announces Increase in Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 14, 2019 / Financial

Standard Motor Products, Inc. Announces Fourth Quarter and 2018 Year End Results

Vehicle Control Temperature Control Engineered Solutions

April 30, 2019 / Financial

Standard Motor Products, Inc. Announces First Quarter 2019 Results and a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

July 25, 2019 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2019 Results and a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

October 30, 2019 / Financial

Standard Motor Products, Inc. Announces Third Quarter 2019 Results and a Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 22, 2023 / Financial

Standard Motor Products, Inc. Releases Fourth Quarter and 2022 Year-End Results; Announces Segment Reporting Changes

Vehicle Control Temperature Control Engineered Solutions

August 01, 2024 / Financial

SMP Announces Second Quarter 2024 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

July 29, 2024 / Financial

SMP Announces Second Quarter 2024 Earnings Conference Call

Vehicle Control

April 01, 2019 / Financial

Standard Motor Products, Inc. Announces Acquisition of Pollak Business of Stoneridge, Inc.

Vehicle Control Temperature Control Engineered Solutions Nissens

July 10, 2024 / Financial

SMP to Acquire European Aftermarket Supplier Nissens Automotive

Vehicle Control Temperature Control Engineered Solutions

November 29, 2023 / Financial

SMP Directors Recognized

Vehicle Control Temperature Control Engineered Solutions

July 11, 2023 / Financial

Alisa C. Norris Named One of Directors & Boards Magazine’s 2023 Directors to Watch

Vehicle Control Temperature Control Engineered Solutions

February 22, 2023 / Financial

Standard Motor Products, Inc. Announces Segment Reporting Changes

Vehicle Control Temperature Control Engineered Solutions

December 21, 2022 / Financial

Standard Motor Products, Inc. Announces Director Changes

Vehicle Control Temperature Control Engineered Solutions

April 04, 2022 / Financial

Standard Motor Products, Inc. Announces Appointment of New Director

Vehicle Control Temperature Control Engineered Solutions

December 15, 2021 / Financial

Standard Motor Products, Inc. Announces Appointment of New Director

Vehicle Control Temperature Control Engineered Solutions

November 01, 2021 / Financial

Standard Motor Products, Inc. Appoints Anthony Cristello as Vice President of Investor Relations

Vehicle Control Temperature Control Engineered Solutions

May 13, 2020 / Financial

Standard Motor Products, Inc. Announces a Change to the Location of its Annual Meeting of Shareholders

Vehicle Control Temperature Control Engineered Solutions

October 25, 2024 / Financial

SMP Announces Third Quarter 2024 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

October 30, 2024 / Financial

SMP Announces Third Quarter 2024 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions Nissens

November 01, 2024 / Financial

SMP Completes Acquisition of European Aftermarket Supplier Nissens Automotive

Vehicle Control Temperature Control Engineered Solutions Nissens

February 03, 2025 / Financial

Standard Motor Products, Inc. Announces Increase in its Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions

February 25, 2025 / Financial

SMP Announces Fourth Quarter and Year End 2024 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions

February 27, 2025 / Financial

SMP Releases Fourth Quarter and 2024 Year-End Results

Vehicle Control Temperature Control Engineered Solutions Nissens

April 25, 2025 / Financial

SMP Announces First Quarter 2025 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions Nissens

April 30, 2025 / Financial

Standard Motor Products, Inc. Releases First Quarter 2025 Results and Quarterly Dividend

Vehicle Control Temperature Control Engineered Solutions Nissens

July 31, 2025 / Financial

Standard Motor Products, Inc. Announces Second Quarter 2025 Earnings Conference Call

Vehicle Control Temperature Control Engineered Solutions Nissens

August 05, 2025 / Financial

Standard Motor Products, Inc. Releases Second Quarter 2025 Results and Quarterly Dividend

Vehicle Control Temperature Control

June 25, 2024 / Product

SMP Adds 186 New Numbers in June Announcement

Vehicle Control Temperature Control

May 22, 2024 / Product

Standard Motor Products Introduces 200 New Numbers

Vehicle Control

May 06, 2024 / Product

Standard Motor Products Expands Camshaft and Crankshaft Sensor Program

Vehicle Control Temperature Control

April 23, 2024 / Product

Standard Motor Products Introduces 268 New Numbers

Vehicle Control Temperature Control

March 27, 2024 / Product

Standard Motor Products Announces 123 New Numbers

Vehicle Control

March 25, 2024 / Product

Pollak® Introduces New Line of Trailer Connectors and Accessories

Vehicle Control Temperature Control

February 27, 2024 / Product

SMP Releases 118 Numbers in February Announcement

Vehicle Control Temperature Control

December 18, 2023 / Product

SMP Releases 2,626 New Numbers in 2023

Vehicle Control Temperature Control

October 26, 2023 / Product

SMP's October Release Includes 276 New Numbers

Vehicle Control

October 11, 2023 / Product

Standard Motor Products Expands Oil Filter Housing Kit Program

Vehicle Control Temperature Control

August 23, 2023 / Product

Standard Motor Products’ August Release Includes 210 New Part Numbers

Vehicle Control Temperature Control

July 26, 2023 / Product

Standard Motor Products’ July Release Includes 207 New Part Numbers

Vehicle Control Temperature Control

June 21, 2023 / Product

SMP Releases 156 New Part Numbers in June

Vehicle Control Temperature Control

May 24, 2023 / Product

Standard Motor Products’ May Release Includes 222 New Part Numbers

Vehicle Control Temperature Control

April 27, 2023 / Product

Standard Motor Products Releases 373 New Part Numbers in April

Vehicle Control Temperature Control

March 08, 2023 / Product

Standard Motor Products Expands Hybrid and EV Product Offering

Vehicle Control Temperature Control

December 22, 2022 / Product

Standard Motor Products Closes the Year with 214 New Part Numbers

Vehicle Control

November 03, 2022 / Product

Standard Motor Products Expands Collision Repair Program Offering

Vehicle Control Temperature Control

October 25, 2022 / Product

Standard Motor Products Launches 365 New Numbers

Vehicle Control

October 03, 2022 / Product

Standard Motor Products Continues Growth of Ignition Coil Program

Vehicle Control Temperature Control

August 25, 2022 / Product

Standard Motor Products Introduces Over 300 New Part Numbers

Vehicle Control Temperature Control

July 28, 2022 / Product

Standard Motor Products Releases 832 New Part Numbers in First Half of 2022

Vehicle Control Temperature Control

June 29, 2022 / Product

Standard Motor Products Introduces 119 New Part Numbers

Vehicle Control

June 23, 2022 / Product

Standard Motor Products Introduces New Blue Streak® Products

Vehicle Control Temperature Control

May 02, 2022 / Product

Standard Motor Products Releases 138 New Part Numbers

Vehicle Control

April 25, 2022 / Product

Standard Motor Products Expands Electronic Throttle Body Offering

Vehicle Control Temperature Control

March 30, 2022 / Product

Standard Motor Products Releases 434 New Part Numbers

Vehicle Control

November 02, 2020 / Product

Standard Motor Products Releases Blue Streak® Variable Valve Timing Program

Vehicle Control

September 10, 2020 / Product

Standard Motor Products Releases 245 New Parts for Standard® and Intermotor®

Vehicle Control

August 10, 2020 / Product

Standard Motor Products Releases New Blue Streak® Blower Motor Resistor Kits

Vehicle Control

May 11, 2020 / Product

Standard Motor Products Releases 230 New Parts for Standard® and Intermotor®

Vehicle Control Temperature Control

December 19, 2024 / Product

SMP Releases 2,367 New Numbers in 2024

Vehicle Control

November 11, 2024 / Product

Standard Motor Products Broadens Collision Repair Program

Vehicle Control

February 06, 2025 / Product

Standard Motor Products Continues to Expand Oil Filter Housing Program

Vehicle Control

March 20, 2025 / Product

Standard Motor Products Expands Line of Gasoline Fuel Injectors

Vehicle Control Temperature Control

March 28, 2025 / Product

Standard Motor Products Releases 170 New Numbers

Vehicle Control

April 15, 2025 / Product

Standard Motor Products Expands Parking Brake Actuator Program

Vehicle Control

June 11, 2025 / Product

Standard Motor Products’ Evaporative Emissions Program Expands

Vehicle Control Temperature Control

July 07, 2025 / Product

Standard Motor Products Releases New Numbers in 35 Categories

Vehicle Control Temperature Control

October 03, 2025 / Product

Standard Motor Products Announces New Numbers in 31 Categories

Vehicle Control Temperature Control Engineered Solutions

June 20, 2024 / Corporate

SMP Named a U.S. News and World Report Best Company to Work For

Vehicle Control Temperature Control Engineered Solutions

June 05, 2024 / Corporate

SMP Once Again Recognized as a Climate Leader

Vehicle Control Temperature Control Engineered Solutions

May 15, 2024 / Corporate

SMP Announces Release of its 2023 Corporate Sustainability Report

Vehicle Control Temperature Control

January 08, 2024 / Corporate

SMP Pro Training Power Hour 2024 Schedule Announced

Vehicle Control Temperature Control Engineered Solutions

December 06, 2023 / Corporate

SMP Named One of America’s Most Responsible Companies

Vehicle Control Temperature Control Engineered Solutions

June 15, 2023 / Corporate

Standard Motor Products Launches New Corporate Website

Vehicle Control Temperature Control Engineered Solutions

May 30, 2023 / Corporate

SMP Recognized for Sustainability Efforts

Vehicle Control Temperature Control Engineered Solutions

April 19, 2023 / Corporate

Standard Motor Products, Inc. Announces Publication of its 2022 Corporate Sustainability Report

Vehicle Control Temperature Control Engineered Solutions

April 10, 2023 / Corporate

SMP Receives APSG Vendor of the Year Award and Eric Sills Inducted into Hall of Fame

Vehicle Control Temperature Control

January 09, 2023 / Corporate

SMP Announces New Pro Training Power Hour

Vehicle Control Temperature Control Engineered Solutions

April 12, 2022 / Corporate

Standard Motor Products, Inc. Announces Publication of its 2021 Corporate Social Responsibility and Sustainability Report

Vehicle Control Temperature Control Engineered Solutions

June 07, 2022 / Corporate

Standard Motor Products Wins 2021 Spirit of NAPA Award

Vehicle Control Temperature Control Engineered Solutions

June 16, 2022 / Corporate

SMP Receives Extra Miler Award from AutoZone

Vehicle Control Temperature Control Engineered Solutions

June 27, 2022 / Corporate

Standard Motor Products, Inc. Announces the Passing of Director John Gethin

Vehicle Control Temperature Control Engineered Solutions

August 04, 2022 / Corporate

Standard Motor Products Wins Waytek New Product of the Year Award

Vehicle Control Temperature Control Engineered Solutions

August 09, 2022 / Corporate

SMP Becomes Gold Lifetime Trustee of University of the Aftermarket Foundation

Vehicle Control Temperature Control Engineered Solutions

November 02, 2022 / Corporate

SMP CEO Eric Sills Receives AASA Advocacy Award

Vehicle Control Temperature Control Engineered Solutions

November 30, 2022 / Corporate

Standard Motor Products’ SMP Cares Initiative Gives Back in 2022

Vehicle Control Temperature Control Engineered Solutions

February 25, 2021 / Corporate

Standard Motor Products, Inc. Announces Publication of its 2020 Corporate Social Responsibility and Sustainability Report

Vehicle Control Temperature Control

March 01, 2021 / Corporate

Standard Motor Products Names Dave Illes Director of Sales, Heavy Duty Aftermarket

Vehicle Control Temperature Control Engineered Solutions

March 04, 2021 / Corporate

Standard Motor Products Named 2020 Supplier of the Year by O’Reilly Auto Parts

Vehicle Control Temperature Control Engineered Solutions

March 22, 2021 / Corporate

SMP Named 2020 Supplier of the Year by Parts Authority

Vehicle Control

September 22, 2021 / Corporate

Standard Motor Products Awards $50,000 Across Three Scholarship Programs

Vehicle Control Temperature Control Engineered Solutions

October 14, 2021 / Corporate

SMP CEO Eric Sills Testifies before the U.S. House Of Representatives Committee on Energy & Commerce

Vehicle Control

March 13, 2020 / Corporate

Standard Motor Products to Award $20,000 During Blue Streak® ‘Better Then, Better Now’ Automotive Scholarship Contest

Vehicle Control

March 25, 2020 / Corporate

Standard Motor Products to Recognize Aspiring Diesel Technicians With Its Standard® ‘Bigger, Better Diesel’ $5000 Scholarship Contest

Vehicle Control Temperature Control Engineered Solutions

April 15, 2020 / Corporate

Standard Motor Products Recognizes Shops with 'Standing Together' Promotion

Vehicle Control Temperature Control Engineered Solutions

April 20, 2020 / Corporate

Standard Motor Products Donates Snacks for April to Mount Sinai Queens Hospital Staff

Vehicle Control Temperature Control Engineered Solutions

April 23, 2020 / Corporate

Standard Motor Products Manufactures Heat Exchangers For Medical Oxygen Devices

Vehicle Control Temperature Control Engineered Solutions

May 14, 2020 / Corporate

Standard Motor Products Announces Launch of New SMP Cares Website

Vehicle Control Temperature Control Engineered Solutions

June 02, 2020 / Corporate

Standard Motor Products Announces the Winners of its SMP ‘Standing Together’ Promotion

Vehicle Control Temperature Control

June 09, 2020 / Corporate

Standard Motor Products Launches the Updated SMP Parts App

Vehicle Control

August 03, 2020 / Corporate

Standard Motor Products Launches the SMP ‘Your Car. Your Data. Sweepstakes’

Vehicle Control

September 16, 2020 / Corporate

Standard Motor Products Announces the Winners of its Women in Auto Care Scholarship

Vehicle Control

November 10, 2020 / Corporate

Standard Motor Products Names Winners of Its Standard® ‘Bigger, Better Diesel’ Scholarship

Vehicle Control Temperature Control

November 17, 2020 / Corporate

Standard Motor Products Launches Automotive Education Program

Vehicle Control

December 16, 2020 / Corporate

Standard Motor Products Awards $20,000 to its Blue Streak® Scholarship Winners

Vehicle Control

January 14, 2019 / Corporate

Standard Motor Products Adds 10,000th Subscriber to its Standard® Brand YouTube Channel

Vehicle Control Temperature Control Engineered Solutions

January 17, 2019 / Corporate

Standard Motor Products Named ‘2018 Supplier of the Year’ by O’Reilly Auto Parts

Vehicle Control Temperature Control Engineered Solutions

January 24, 2019 / Corporate

Standard Motor Products Launches New Corporate, Investor Relations, and Standard® Brand Websites

Vehicle Control Temperature Control Engineered Solutions

January 24, 2019 / Corporate

Standard Motor Products, Inc. Appoints James Burke as Chief Operating Officer

Vehicle Control

February 19, 2019 / Corporate

Standard Motor Products Announces Fifth Annual Intermotor® ‘Import Leader’ Automotive Scholarship Contest

Vehicle Control

March 18, 2019 / Corporate

Standard Motor Products to Recognize Aspiring Diesel Technicians During Its Standard® ‘Bigger, Better Diesel’ Scholarship Contest

Vehicle Control Temperature Control Engineered Solutions

April 22, 2019 / Corporate

Standard Motor Products, Inc. Celebrates 100th Anniversary

Vehicle Control Temperature Control Engineered Solutions

May 14, 2019 / Corporate

Standard Motor Products Hires Jack Ramsey as New VP of Engine Management Marketing and Sales

Vehicle Control Temperature Control Engineered Solutions

September 16, 2019 / Corporate

Standard Motor Products, Inc. Appoints Nathan Iles as Chief Financial Officer

Vehicle Control

September 27, 2019 / Corporate

Standard Motor Products Announces Winner of its ‘Shop Team Selfie’ Challenge

Vehicle Control Temperature Control Engineered Solutions

November 25, 2019 / Corporate

Standard Motor Products Wins Best Electronic Catalog at AAPEX Auto Care Association Import Product and Marketing Awards

Vehicle Control Temperature Control Engineered Solutions

July 16, 2024 / Corporate

SMP Certified as a Most Loved Workplace®

Vehicle Control Temperature Control Engineered Solutions

December 05, 2024 / Corporate

SMP Named One of America’s Most Responsible Companies for Second Consecutive Year

Vehicle Control Temperature Control Engineered Solutions Nissens

February 18, 2025 / Corporate

Standard Motor Products, Inc. Launches New Corporate Website

Vehicle Control Temperature Control Engineered Solutions Nissens

April 23, 2025 / Corporate

Standard Motor Products, Inc. Recognized as a Climate Leader for Third Consecutive Year

Vehicle Control Temperature Control Engineered Solutions Nissens

April 28, 2025 / Corporate

SMP Receives Fisher Auto Parts Standout Star Award

Vehicle Control Temperature Control Engineered Solutions Nissens

June 16, 2025 / Corporate

Standard Motor Products, Inc. Named One of America’s Greatest Workplaces 2025

Vehicle Control Temperature Control Engineered Solutions Nissens

June 19, 2025 / Corporate

Standard Motor Products, Inc. Opens National Distribution Center in Shawnee, Kansas

Engineered Solutions

October 05, 2022 / Financial

Standard Motor Products, Inc. Announces Acquisition of Kade Trading GmbH

Engineered Solutions

September 01, 2021 / Financial

Standard Motor Products, Inc. Announces Acquisition of Stabil Group

Engineered Solutions

June 17, 2024 / Corporate

SMP Receives General Motors Supplier Quality Excellence Award

Engineered Solutions

May 10, 2024 / Corporate

SMP's Trombetta® Awarded Waytek's Outstanding Growth Award for 2023

Engineered Solutions

October 04, 2023 / Corporate

Standard Motor Products, Inc. STABIL Facility Earns PACCAR 2022 10 PPM Award

Engineered Solutions

August 08, 2023 / Corporate